how to claim california renter's credit

The program will determine the amount of credit based on the tax return information. The property was not tax exempt.

Department of Housing and Urban Development.

. Homeowners may be able to deduct some or all of their property taxes and mortgage interest and they can possibly exclude up to 250000 500000 if married of gain when selling their primary residence. California Resident Income Tax Return Form 540 2EZ line 19. To qualify for the Californias Renters Credit you must meet the following.

PHAs in California Links to PHA websites For questions about HUD rental programs including Housing Choice Section 8 Vouchers contact our Public and Indian Housing PIH Resource Center. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing. Department of Housing and Urban Development 451 7th Street SW Washington DC 20410 T.

Visit Nonrefundable Renters Credit Qualification Record for more information. The rent relief program re-authorized in AB 832 pays 100 percent of unpaid rent. The Nonrefundable Renters Credit is a personal income tax credit that is nonrefundable and can only be used to offset your tax liability.

To apply for either type of help visit your local Public Housing Agency PHA. Paid rent in California for at least half the year Made 43533 or less single or marriedregistered domestic partner. The New Jersey tax benefit is interesting because it gives renters a choice as to whether they would prefer a deduction of 18 of rent paid up to 15000 or a credit of 50 on.

A landlord cannot evict a tenant for non-payment of rent for the months in. Claiming the renters credit on your taxes. You paid rent in California for at least 12 the year.

Tax credits help reduce the amount of tax you may owe. The taxpayers California adjusted gross income must be below a. Renter Landlord COVID-19 Relief Program Extended.

From the left of the screen select State Local and choose Other Credits. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if filing. To claim the renters credit for California all of the following criteria must be met.

Email us Call toll-free800 955-2232 Need advice. Part way through 2018 I moved into a room in a house that I am now paying rent to the homeowners and I am not a member of their family so I am unsure if i can still use the Renters Credit. California also has an earned income tax credit that may get you a refund even if you do not owe tax.

To claim the renters credit for California all of the following criteria must be met. You must legally reside the state where you rent your home. The renters who are eligible to receive this tax deduction are different too.

California Resident Income Tax Return Form 540 line 46. It seems like homeowners can get some pretty incredible tax breaks while renters are left out. You were a resident of California for at least 6 full months during 2021.

You must file a tax return. I lived and payed rent in an apartment for all of 2017 and part of 2018. To claim the CA renters credit.

The property rented wasnt exempt from 9. Locate the Renters Credit section. Client paid rent in California for at least half the year.

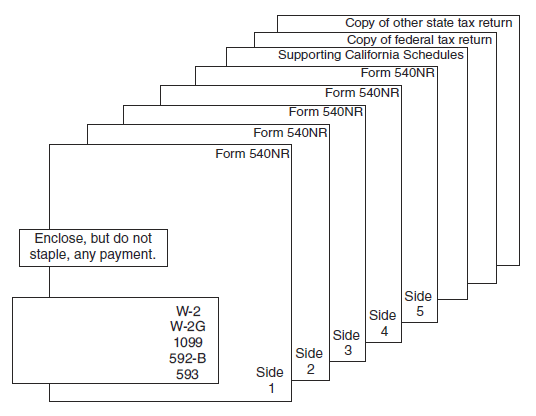

31 so reach out if you dont receive it. Renters must have been impacted by COVID-19 owe rent starting April 2020 or later and make no more than 80 of the local median income. Use one of the following forms when filing.

The taxpayers California adjusted gross income must be. But a few requirements are consistent no matter where you live. The way you claim a renters credit your taxes varies from state to state.

If you pay rent for your housing have a family with children or help provide money for low-income college students you may be eligible for one or more tax credits. Go to the Input Return tab. Theyre required to give it to you by Jan.

February 14 2020 546 PM. Youll need to obtain a Certificate of Rent Paid from your property owner in order to claim the credit. Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com Printable Sample Late Rent Notice Form Late Rent Notice Room.

File a Married Filing Separate or RDP Return Did not live with your SpouseRDP during the last six months of the year Furnish over half of the household expenses for your dependent parents home living with you or not Complete the worksheet in the California Instructions for the credit amount. The Nonrefundable Renters Credit is for California residents who paid rent for their principal residence for at least 6 months in 2021 and whose adjusted gross income does not exceed 45448 90896 for Married Filing Jointly. To claim this credit you must.

California Nonresident or Part-Year Resident Income Tax Return line 61. If you already filed you would have to amend to claim but if you have not filed yet you can go back and add it to your return. To request additional support with your application or appeal call the CA COVID-19 Rent Relief call Center at 833-430-2122.

You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria. To qualify for the CA renters credit. Select CA Other Credits.

Gavin Newsom on June 28 2021 signed legislation that expands and extends the CA COVID-19 Rent Relief program designed to provide financial relief to renters and landlords with unpaid rental debt because of the pandemic. I was able to claim the Renters Credit on my 2017 return. Check the status of your submitted application HERE.

File your income tax return. A few general guidelines for tenants and landlords. Mark the checkbox labeled Qualified renter.

Settlement Agreement Sample Template Business

Rental Deposit Refund Letter Sample

Free Lease Application Template Pdf 262kb 2 Page S Page 2

Sample Bill Of Sale Alabama Template Forms 2022

The Type Of Home Insurance You Choose Makes A Big Difference California Apartments Blog

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Here Are The States That Provide A Renter S Tax Credit Rent Blog

Free 9 Sample Rental Application Forms In Pdf Ms Word Excel

Irs Form 540 California Resident Income Tax Return

How To Add An Eviction To A Tenant S Credit Report

Figure Home Equity Line Of Credit Heloc Review Heloc Line Of Credit Lending Company

Credit Cards That Offer Car Rental Coverage The Points Guy Good Credit Best Credit Cards The Points Guy